Blended Finance,

Made Simple

Catalysing Change: How Blended Finance Builds on Traditional Models

What's in this guidebook

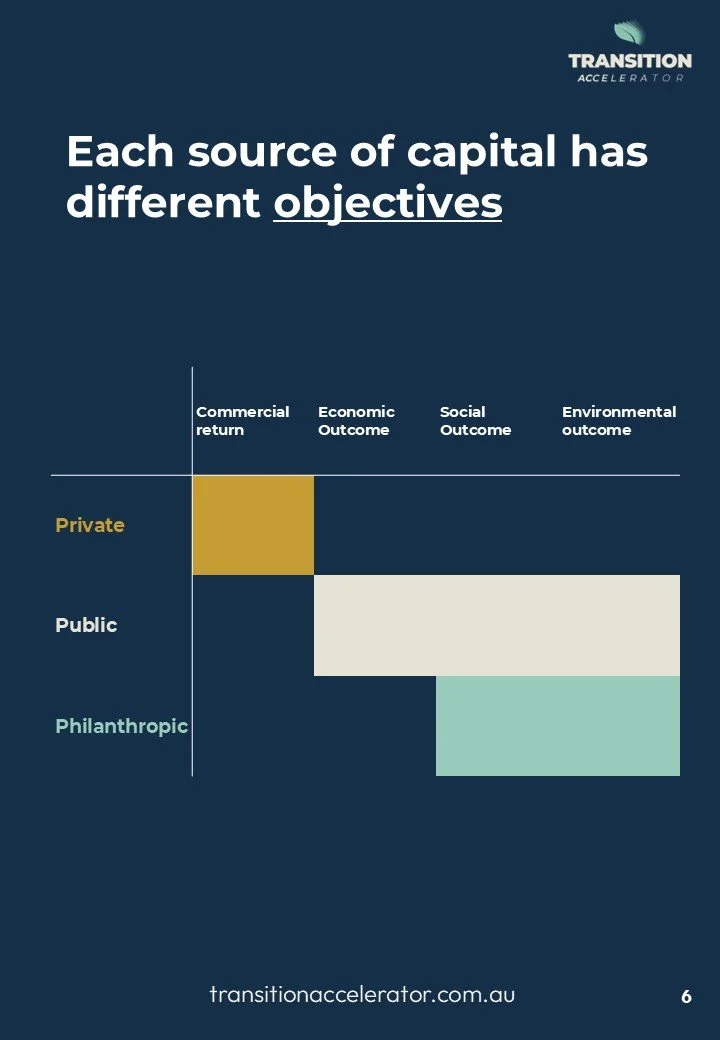

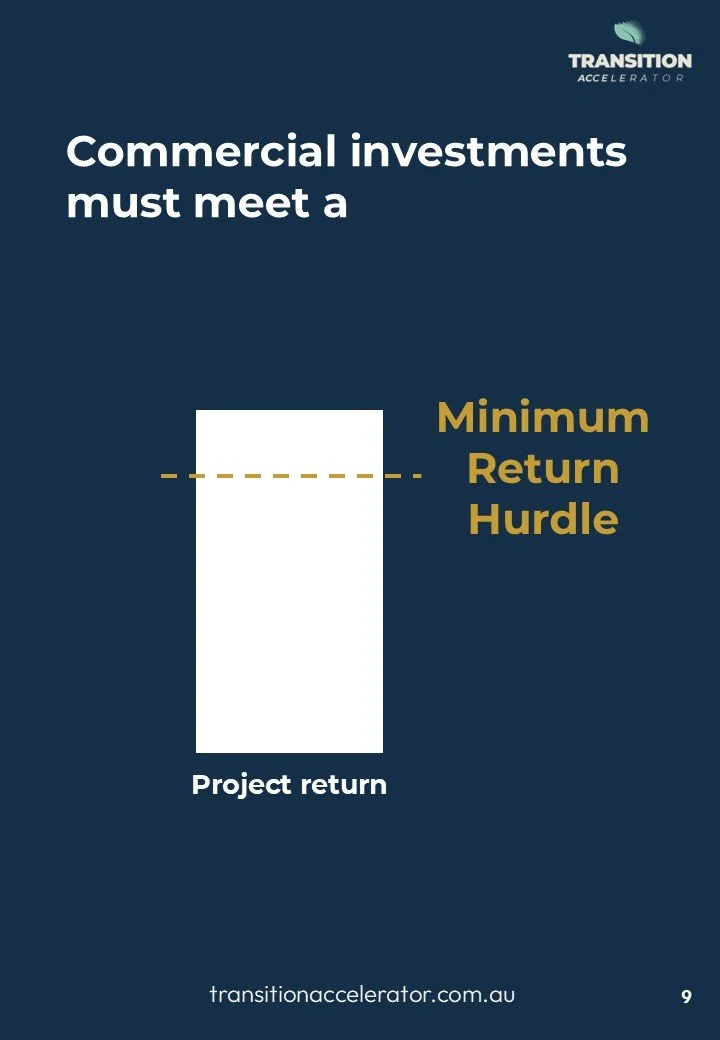

In the world of finance, commercial investors primarily seek financial returns. Their goal is to grow capital while managing risk.

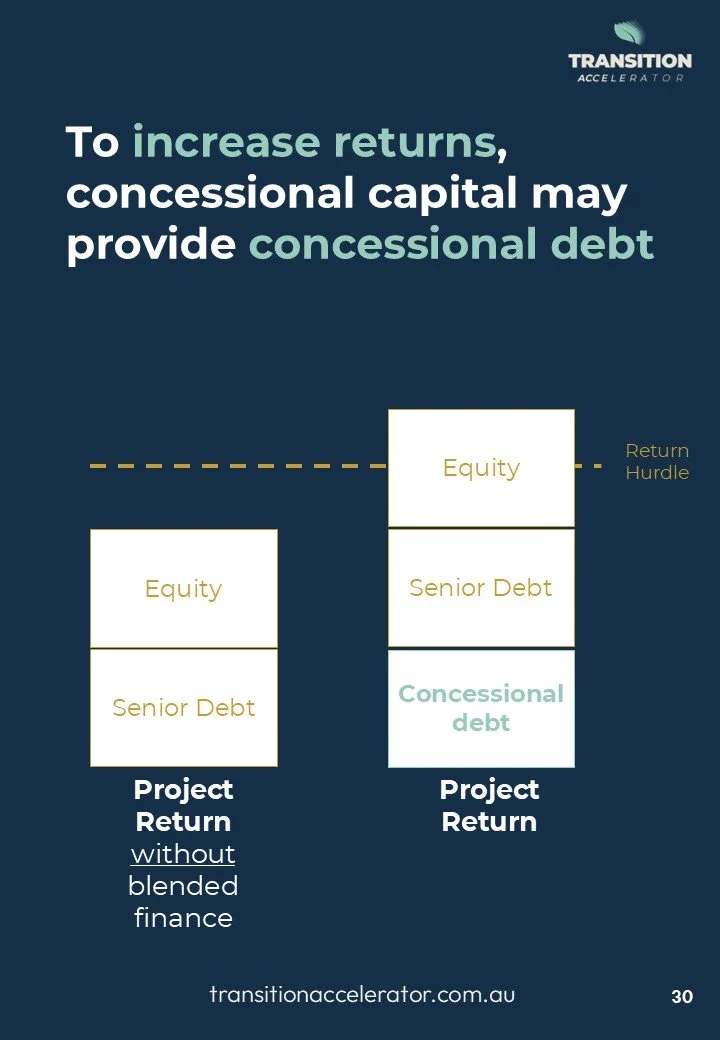

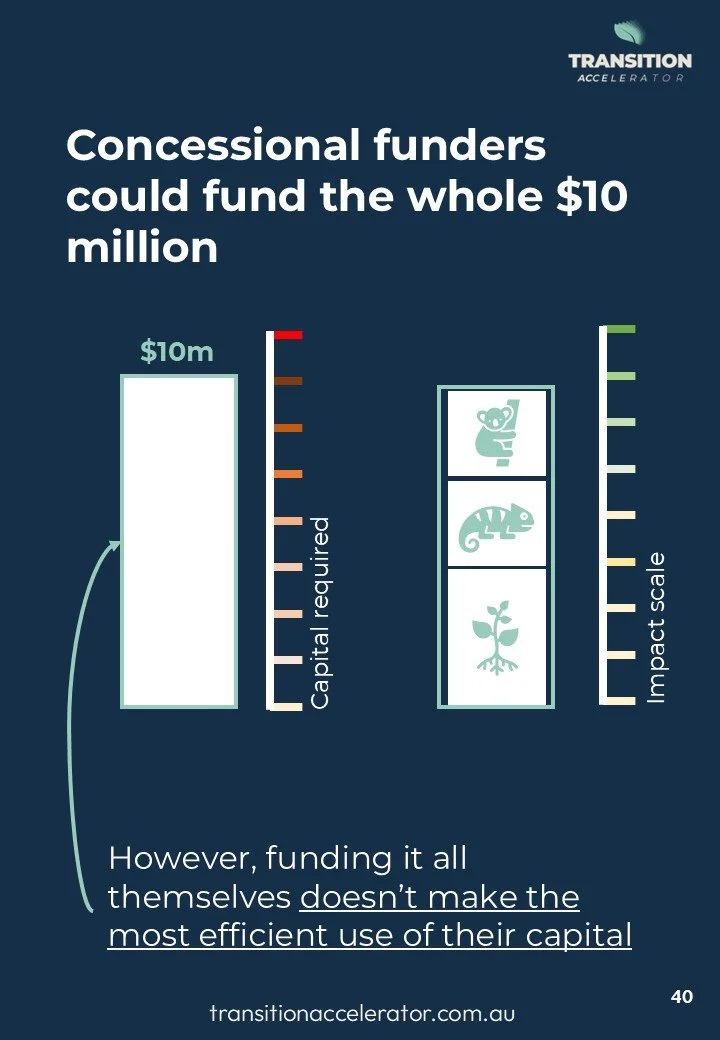

On the other hand, philanthropic and concessional capital have a different purpose: they aim to create social and environmental impact. This capital often accepts lower financial returns or higher risk to achieve outcomes that markets alone won’t deliver.

This guidebook explores how blended finance brings these two types of capital together. By blending concessional and philanthropic funds with commercial investment, we can unlock larger pools of capital that drive meaningful impact — while still attracting returns that keep markets functioning.

Ultimately, this guidebook invites you to rethink traditional finance and philanthropy as separate silos, and instead embrace blended finance as a powerful tool to scale solutions that no single capital source could achieve alone.