Blended Finance,

Made Simple

Why Blended Finance is Built to Scale

What’s in this guidebook

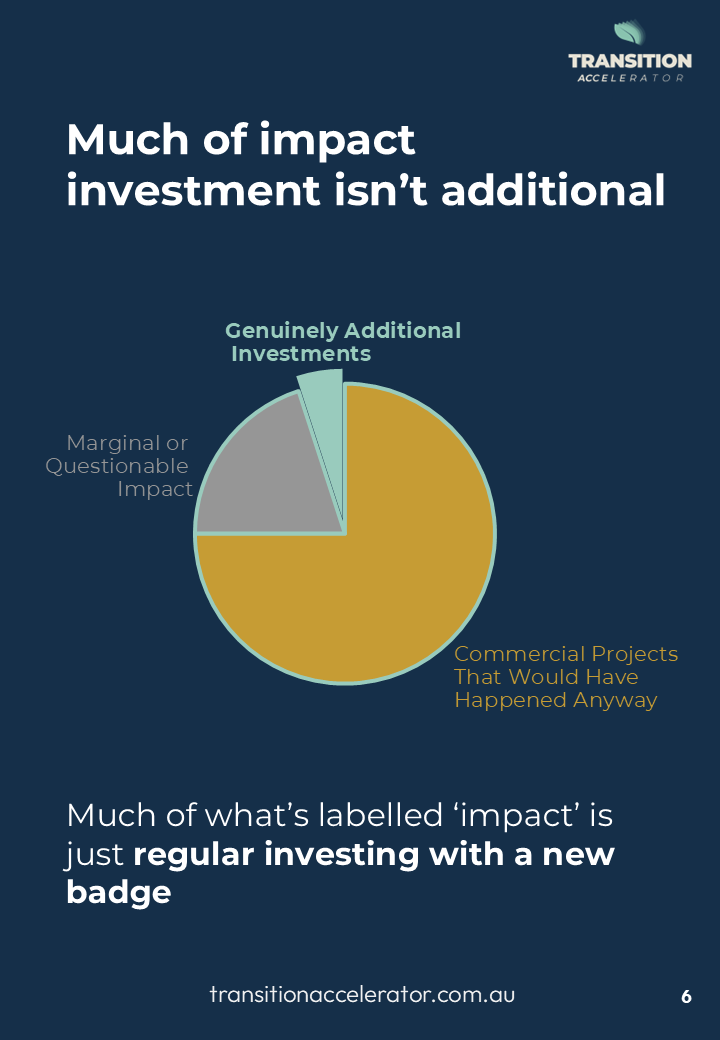

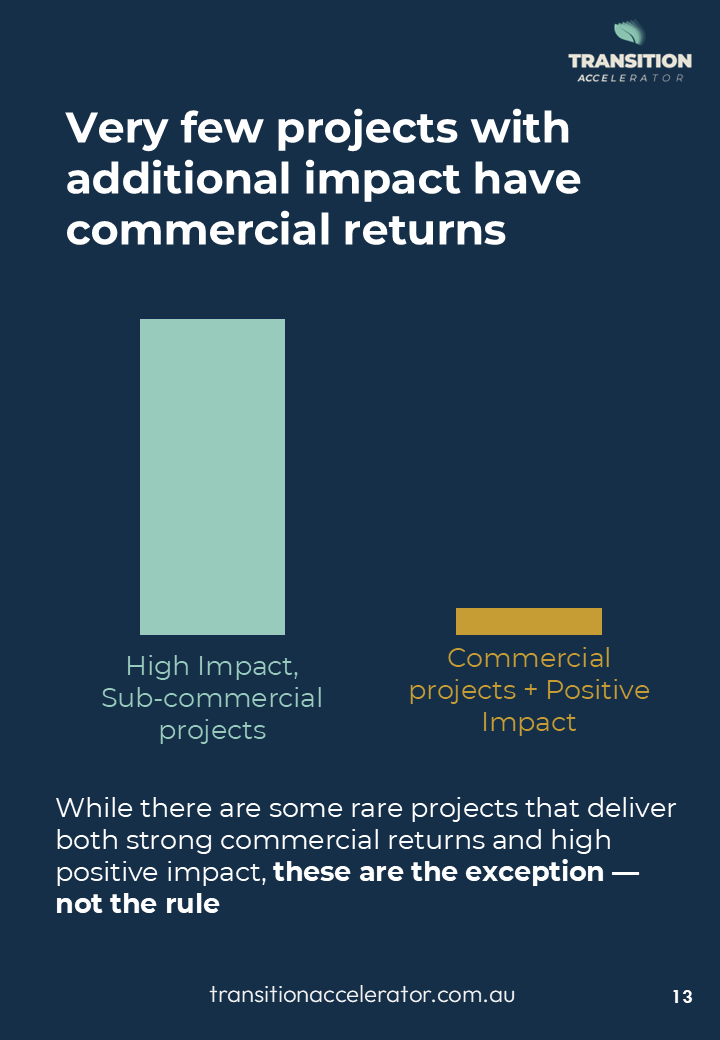

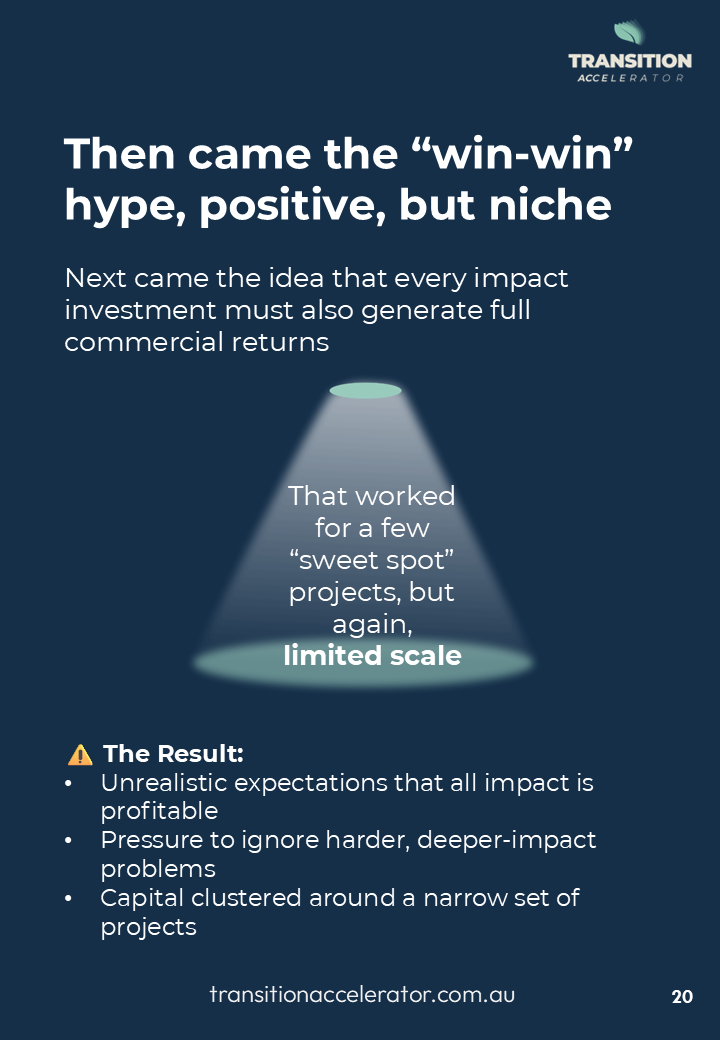

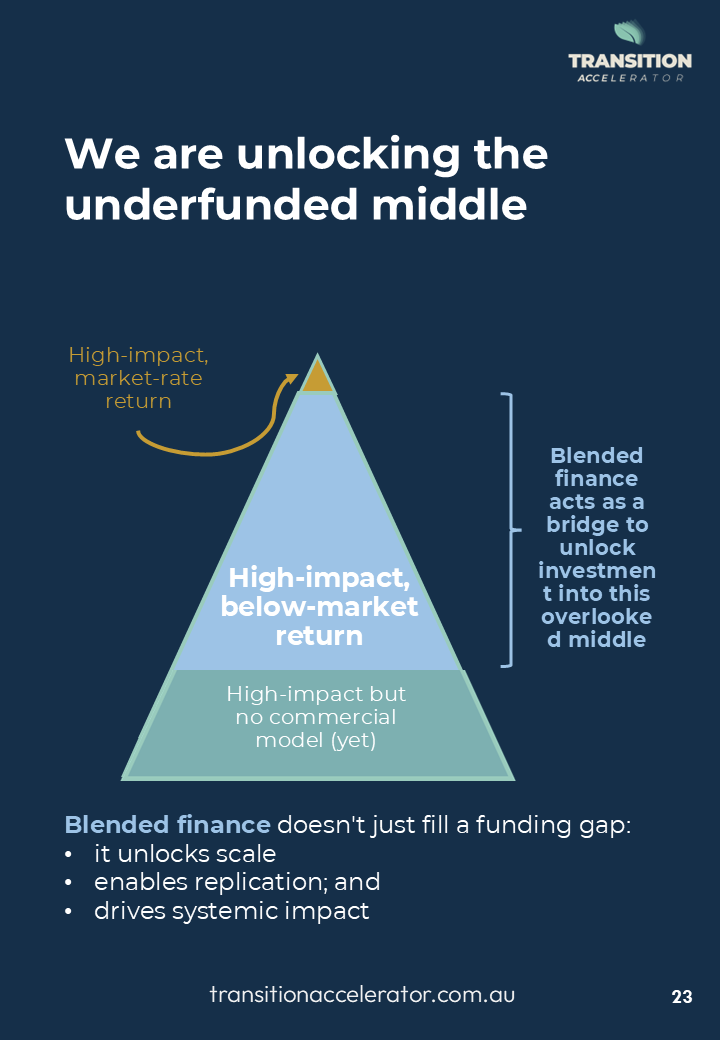

Impact investing has come a long way, but most of the world’s capital is still sitting on the sidelines. While billions have been committed in the name of impact, the projects that most need support are often left out: too risky, too early, or just not quite commercial enough.

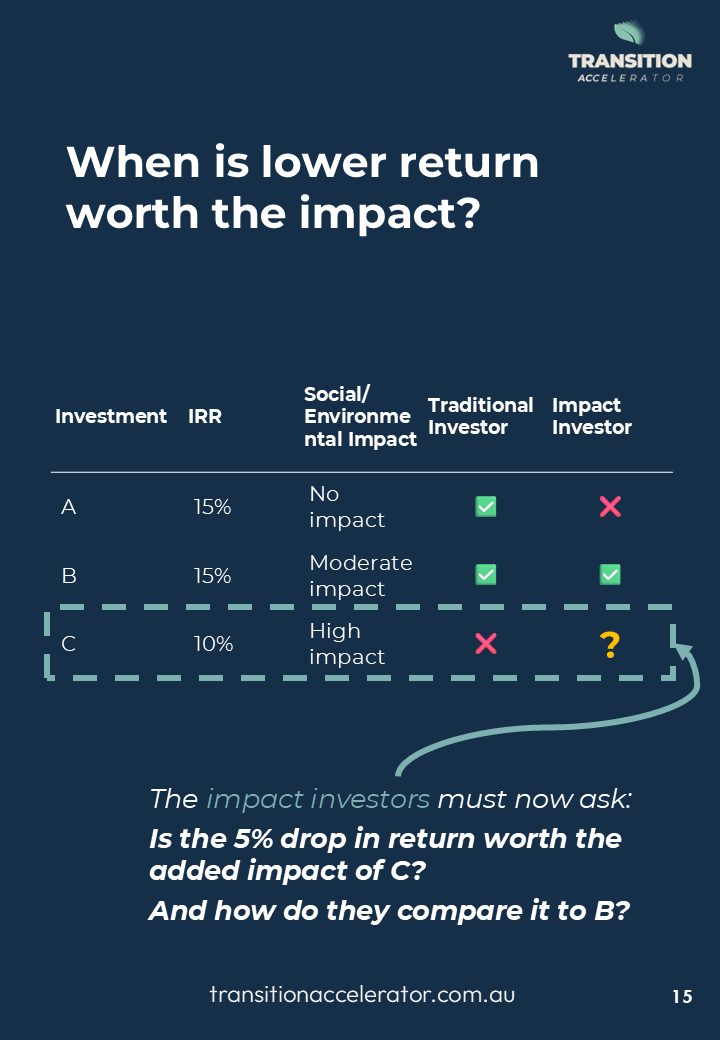

This guidebook is for anyone who’s felt that tension, between wanting to back meaningful outcomes and needing to meet financial expectations. It explains why traditional models fall short, and how blended finance offers a better path forward.

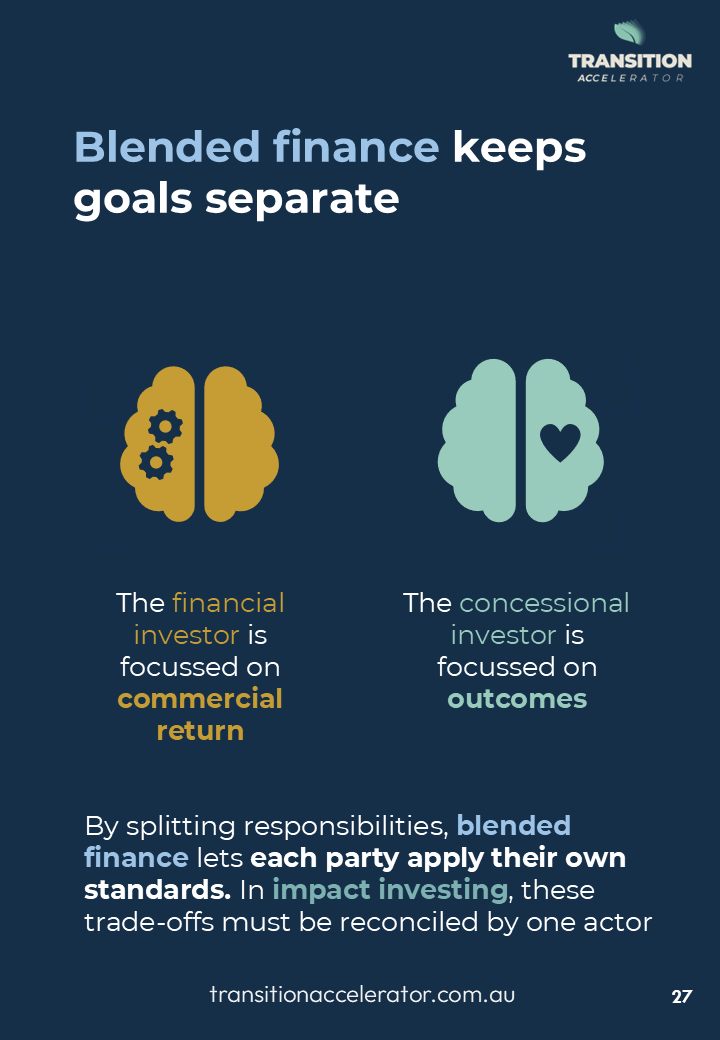

Blended finance isn’t a compromise, it’s a strategy. By combining catalytic and commercial capital, we can unlock a whole category of high-impact projects that don’t fit neatly into either philanthropy or private equity. It’s about structuring deals where each party gets what they need, and the project gets done.

Inside, you’ll find a clear breakdown of the challenges in impact investing today, why “win-win” investments are the exception (not the rule), and how concessional capital can be used more strategically to crowd in private money and scale what works.

This guidebook is ultimately a call to action, for funders, investors and institutions to move beyond niche experiments, and toward a scalable approach that can meet the urgency of the moment. Because when impact is designed into the structure, not just the pitch, we can do more than good. We can do what’s necessary.